RBI’s obstinate refusal to cut policy rates, and the moving of its policy stance from neutral to accommodative, is not based on economic logic. Both headline and core inflation data argue for a rate cut

Amidst much fanfare, and great expectations, India joined the rest of the world by forming a monetary policy committee (MPC). This six-member committee started operations in September 2016 and has been involved in three major policy announcements — one each in October and December 2016, and one in the recently concluded meeting on 8 February, 2017. While early, it is time, nevertheless, to evaluate how good this experiment has been and whether the MPC decisions have been in the interests of the nation.

Each of the three MPC meetings have wrong-footed analysts and economists. At the October meeting, the RBI reduced the policy rate by 25 bp to 6.25 per cent. Only 40 per cent of market analysts expected a rate cut. Both in December and February, more than 90 per cent of analysts expected a rate cut of at least 25 bp — yet, the RBI held rates steady. Further, at the February meeting, the RBI surprised the market with an ultra-hawkish change in its policy stance from “accommodative” to “neutral”. Though there is no easy way to verify, it is extremely unusual for any central bank to go so much against consensus — and do so for three consecutive meetings.

Some eager RBI supporters see the RBI’s policy stance of moving to neutral as enhancing the credibility of the institution; some others (including myself) see this not-logically argued decision as the most damaging blow to the credibility of the RBI.

Why was consensus of a rate cut near-universal for the December and February meetings? Because the RBI had explicitly communicated at the October rate cut meeting that it was targeting a real policy rate of 125 basis points above its target inflation rate of 4 per cent. Given the present policy rate of 6.25 per cent, this means that if an inflation rate of 4.5 per cent is considered sustainable, then the policy rate should be no more than 5.75 per cent, that is, there was at least 50 bp of rate cuts at the February meeting.

In October 2017, when the RBI did cut interest rates by 25 bp, the three preceding headline y-o-y inflation numbers available to it, for June, July and August 2016, were 5.8, 6.1 and 5 per cent respectively. The August inflation number just met the new RBI criteria and the RBI reduced the policy premium to 125 bp to justify the rate cut. If the RBI had not reduced its real target rate from 1.75 per cent to 1.25 per cent, the MPC would not have been able to cut rates.

At the February meeting, the RBI had the following latest inflation levels: 4.2, 3.6 and 3.4 per cent for October, November and December respectively. Even the pre-demonetisation October inflation level of 4.2 per cent (if considered sustainable) would have justified rate cuts upto 100 basis points. So, why no rate cut at the December (and February) meeting? The nation wants to know.

The MPC answer for no rate cuts and a move towards neutral from accommodative was provided by Governor Urjit Patel in a TV interview on 17 February: “The committee felt that inflation, excluding food and fuel, is something that has been stubborn since September-October and has shown little sign of coming decisively below 5 per cent.”

Monetary policy makers concentrate on core inflation because it is a good yardstick for measuring “sustainable inflation”: Which means that core inflation has to be correctly measured. Unfortunately, core inflation is mis-measured in India because the CPI for Fuel and Light includes kerosene and electricity, but excludes petrol. True core would exclude food, fuel and petrol. The reason monetary policy should be concerned with true core is because the excluded items are broadly outside the influence of monetary policy. For example, it is a bit difficult to argue that the RBI’s repo rate policy can affect OPEC’s pricing policy for oil!

To correctly evaluate RBI policy, we need to keep the following definitions in mind:

(False) India Core Inflation = CPI Inflation excluding (Food + Fuel) inflation; and, (True) Core inflation, worldwide (and at RBI) = CPI Inflation excluding (Food + Fuel + Petrol) inflation

The RBI is well aware of the problem of wrongly measured core inflation in India. Hence, it has continuously warned, and emphasised, that inflation excluding food and fuel is not an adequate representation of core inflation. For example, in the September 30, 2014 Policy Statement (PS), the RBI warned that “CPI inflation excluding food and fuel decelerated to its lowest level in the new series, mainly on account of sharp disinflation in transport and communication”. In the February 3, 2015 PS, the RBI said: “Inflation excluding food and fuel declined for the second consecutive month in December. This was largely on account of the declining prices of transport and communication since August, reflecting the impact of plummeting international crude oil prices.”

A true core price index can easily be constructed by excluding the effects of petrol consumption from the transport and communication (TC) basket (TC has a weight of 8.59 per cent in the CPI and petrol consumption weight is 2.4 per cent), and adding it to the basket of Fuel. (CSO, please note and correct the Fuel index to include petrol, and exclude petrol from transportation and communications).

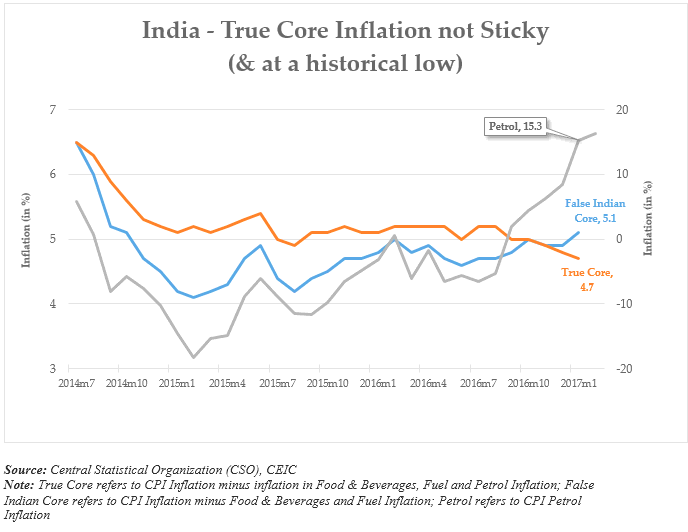

The correct and incorrect core inflation series, along with petrol price inflation, are reported in the chart. Note three important facts. First, twists and turns in false core inflation seem to be closely aligned with twists and turns in petrol price inflation. The stickiness in false core reflects the fact that crude prices have been rising at a fast clip (65 per cent y-o-y increase in the price of crude oil, 15 per cent increase in the domestic price of petrol).

Second, true core inflation, at 4.8 per cent in December 2016 (even lower at 4.7 per cent in January 2017, a data point the RBI did not have on February 8) is on a declining trend and at the lowest level since the new CPI series started in 2011. Third, extending the CPI series backwards to 1990 (using CPI-IW, CPI for industrial workers) yields the result that CPI minus petrol inflation was at 3 per cent in January (and 3.3 per cent in December) — the lowest level since June 2005.

These facts counter the post-truth core inflation scenario painted by the RBI. All six members of the MPC, somewhat co-incidentally, cite the wrong core index to justify no rate cut. All three RBI members, and Ravindra Dholakia, support the changed policy stance as revealed by the minutes of the February 8 meeting— Ghate, Dua: Core Inflation remains sticky; Dholakia: Core inflation continues to be high, around 5 per cent. Patra: The recent sharp disinflation is entirely driven by transitory forces. Underneath, there is a broader-based firming up of inflation pressures.

Excluding both food and fuel, inflation was 4.9 per cent. Moreover, all of these levels have become persistent since September 2016. Acharya: Core inflation has been more or less sticky in recent months. Patel: Core inflation has remained sticky, notwithstanding the transitory impact of demonetisation on consumption demand.

For a central banker, there is no bigger “crime” than to be logically, and knowingly, inconsistent. The MPC conclusion is disingenuous, because its members knew and know that inflation excluding food and fuel is

mis-measured in India.

So, let us see the incredulous RBI policy decision in the correct and credible true light. Inflation, and true core inflation, is at the lowest levels in at least six years, and possibly, the last 11 years. It has been steadily declining for the last several years, and especially the last six months. Yet, the MPC unanimously emphasises that core inflation is sticky at an unacceptable level.

How can inflation be both sticky, uncomfortably high, and the lowest in history? Again, the nation wants to know.