We all have a choice — we can either debate evidence, or manufacture conclusions

In what will go down (sadly) as the most perfect anticipation, I had said (‘Data vs gossip: who should win’, IE, September 30; hereafter DvG): “My plea — let us debate evidence, and debate how to interpret the facts. Let us not decline into ideology, and worse, into personal attacks. The economy should not be treated like a gossip column.” Since then, two articles, Himanshu (‘Face the decline’, IE, October 6) and my old friend Pronab Sen, (‘The takedown that isn’t’, IE, October 11), have questioned my integrity, and worse. I don’t want to begrudge anyone their 15 minutes of ideological Twitter fame; instead, I will present evidence so the reader can judge for herself who is playing fair and who is allowing ideology, and political preferences, to come in the way of their analysis, and honesty.

Himanshu introduces his analysis thus: “There is now a consensus that the economy has been slowing down and is headed for a hard landing”. He then applauds Yashwant Sinha’s bravery (‘I need to speak up now’, IE, September 27) and concludes “the rest are afraid to speak out for fear of retribution”. This is what I had stated in a piece published eight days before Sinha’s oratory: “The GDP growth number for the latest quarter (2017Q2) was bad, very bad. It came in at a year-on-year growth of 5.7 per cent… the eighth worse quarter since 2011, and the 14th worst quarter since the start of high growth in 2003-04. It is imperative that the political and economic policymakers in the Modi government get down to identifying the cause of this downturn”. (‘It is interest rates, stupid’, IE, September 19; hereafter IRS) In my DvG piece, I stated: “I want to end with the following puzzle to several critics, and supporters, of the government. There is a lot of anecdotal evidence about the poor, and not so poor, losing their jobs because of demonetisation. If the poor are really losing out, it should show up in the rate of growth of real wages… If there are jobs being lost in urban areas (MSMEs etc) the impact should show up in the slowing of real wage growth of ploughmen and carpenters. But the opposite is happening.” To make clear what I was saying, I presented a chart entitled, ‘Rural Labour Wage Growth in India’ which presented data from December 2015 for y-o-y wage growth for a ploughman (unskilled) and a carpenter (skilled). Himanshu finds data on ploughmen and carpenters as unrepresentative of agriculture and non-agriculture occupations. Further, Himanshu talks only about levels of real wages, whereas I only talked about growth of real wages.

The table (Real Wage Levels, Growth Rates and Acceleration) gives the level of real wage in 2014, and what happened to such wages in 2015, 2016, and 2017. As in my original article, to control for seasonality in different years, I only look at the rate of growth of wages for January-July for the simple reason that 2017 data is only available till July.

|

Table 1: Real Wage Levels, Growth Rates and Acceleration |

|||||

|

Labour Category |

Real Wage |

Real Wage Growth |

Acceleration |

||

|

January – July (y-o-y) |

|||||

|

2014 |

2015 |

2016 |

2017 |

2016-17 |

|

|

Ploughmen |

224 |

0.0 |

-1.6 |

3.0 |

4.6 |

|

General Agricultural |

188 |

0.6 |

-0.5 |

3.9 |

4.4 |

|

Carpenter |

285 |

2.2 |

-0.5 |

2.6 |

3.1 |

|

General Non-Agricultural |

202 |

-0.8 |

-1.9 |

2.5 |

4.4 |

|

Source: Labour BureauNotes: Compound annual growth rates; real wage is nominal wage deflated by CPI rural, 2012=100 |

|||||

I presented growth of wage data and said that there was a puzzle as to why these wages had risen, let alone accelerated post demonetisation. But this puzzle gets a Goebbels-like twist by Himanshu: “Bhalla… has found that demonetisation has contributed to rising rural wages.” As evidence, Himanshu provides graphs on wage levels, not wage growth rates. I had presented data on ploughmen and carpenters which both Himanshu and Sen consider as cherry picking. Given the above rates of growth (general non-agriculture with 1.3 percentage point higher acceleration in 2017 than carpenters), I guess I picked spoilt cherries. I wish Himanshu had written his article earlier.

To summarise: I present data on wage growth, Himanshu counters with data on wage levels. I state that the solid wage growth is a puzzle, given demonetisation, and Himanshu says that I said that demonetisation caused wage growth. Finally, I control for seasonality by looking at year-on-year wage growth for different months and Himanshu responds that I am unaware of seasonality.

Then along comes distinguished economist Pronab Sen (former senior adviser, Planning Commission and former chairman of the Indian Statistical Commission) to give his own personal good economist seal of approval to Himanshu’s “analysis”: “Bhalla’s ‘facts’ demand a response from another economist… This [wage] argument has been conclusively demolished by Himanshu on grounds of cherry-picking.” Sen then proceeds to opine on my conclusion that the high real interest rate policy of the RBI was very likely responsible for a large part of the slowdown in Indian growth — pre-and post-demonetisation. (Detailed in DvG and several other articles, for example, ‘Madness again in monetary policy?’, IE, August 19). And then, theory blazing, Sen opines about the determinants of the social rate of time preference and the long-run neutral rate of interest. He concludes that the former should be at 4 per cent, and the latter upwards of 4 per cent.

Sen should know that the real repo rate is one indicator of the rate of time preference and/or the neutral rate of interest. Real 10-year bond-yields are another. Both indicate that real yields are high, very high, in India. However, the monetary policy instrument is the repo, not the 10-year yield. Since its start in April 2001, the real repo rate in India has averaged 0.35 per cent with a maximum level of 6.65 per cent. In just 17 of 197 months (8.6 per cent) has the real repo rate in India been above 4 per cent, Sen’s preferred level. A look at present day reality indicates that the median real repo rate in developed economies has averaged less than -0.6 per cent over the last year, and the corresponding rate for emerging markets, around 0.6 per cent. Real 10-year yields have averaged 1.7 per cent over the last 20 years.

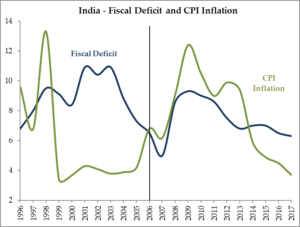

One final word on data, and replicability, and policy. In the latest Monetary Policy Report, the RBI concludes (Box I.1, page 5) that if fiscal deficits expand by 1 per cent, CPI inflation would increase by 0.5 per cent. The background memo (very opaque and not recommended for newspaper column readers) for this controversial conclusion is posted on the RBI website as Mint Street Memo No 5, Farm Loan Waivers, Fiscal Deficit and Inflation. This hard to understand memo was deemed rigorous enough to make it into the MPC’s Monetary Policy Statement: “The possibility of fiscal slippages may add to this [inflation] momentum in the future… Accordingly, the MPC decided to keep the policy rate unchanged.”

Surprisingly, perhaps because of our deficiency in understanding the RBI’s opacity, we have failed to reproduce the RBI result of fiscal deficits affecting inflation with a magnitude of 0.5. We obtain a much lower response — around 0.15. More seriously, the RBI policy conclusion is based on quarterly data for fiscal deficits and inflation. Even more seriously, the quarterly data used by the RBI is not for the full period for which data are available (1996Q2 to 2017Q1) but for a selected and curtailed period 2005Q3 on wards. And even more problematically, the association between fiscal deficits and inflation fails to hold any statistical significance if the period of investigation is for any starting quarter just four quarters earlier — that is, there is no significance if the start of the period of investigation is 2004Q3 or earlier. In the interests of transparency, this is all documented in a short paper entitled “Attempting to Reproduce RBI Results on Fiscal Deficits Causing Inflation‘ (http://ssbhalla.org/blog).

A heuristic summary of the relationship between fiscal deficits and inflation — there isn’t one (any that either we, or RBI, can find on a rigorous basis). Look at the chart which documents inflation and centre-state fiscal deficits (as per cent of GDP) since 1996 (Fiscal Deficits Cause Inflation — Really?). There is a thick line to demarcate RBI’s “cherry” period of analysis. Note the no-relationship ten-year period 1996 to 2006, the very period that the RBI (selectively?) omits. Let me end with my earlier plea. Let us debate evidence, not manufacture conclusions.